Crypto Coins Falling Trends Factors And Future Insights

Crypto coins falling has become a hot topic as investors navigate a fluctuating market that seems to be in a downward spiral. The recent trends indicate significant price declines across various cryptocurrencies, raising questions about the underlying reasons for this downturn.

Several factors are at play, including economic influences, regulatory developments, market sentiment, and technical indicators. Understanding these elements can help investors make informed decisions during these turbulent times.

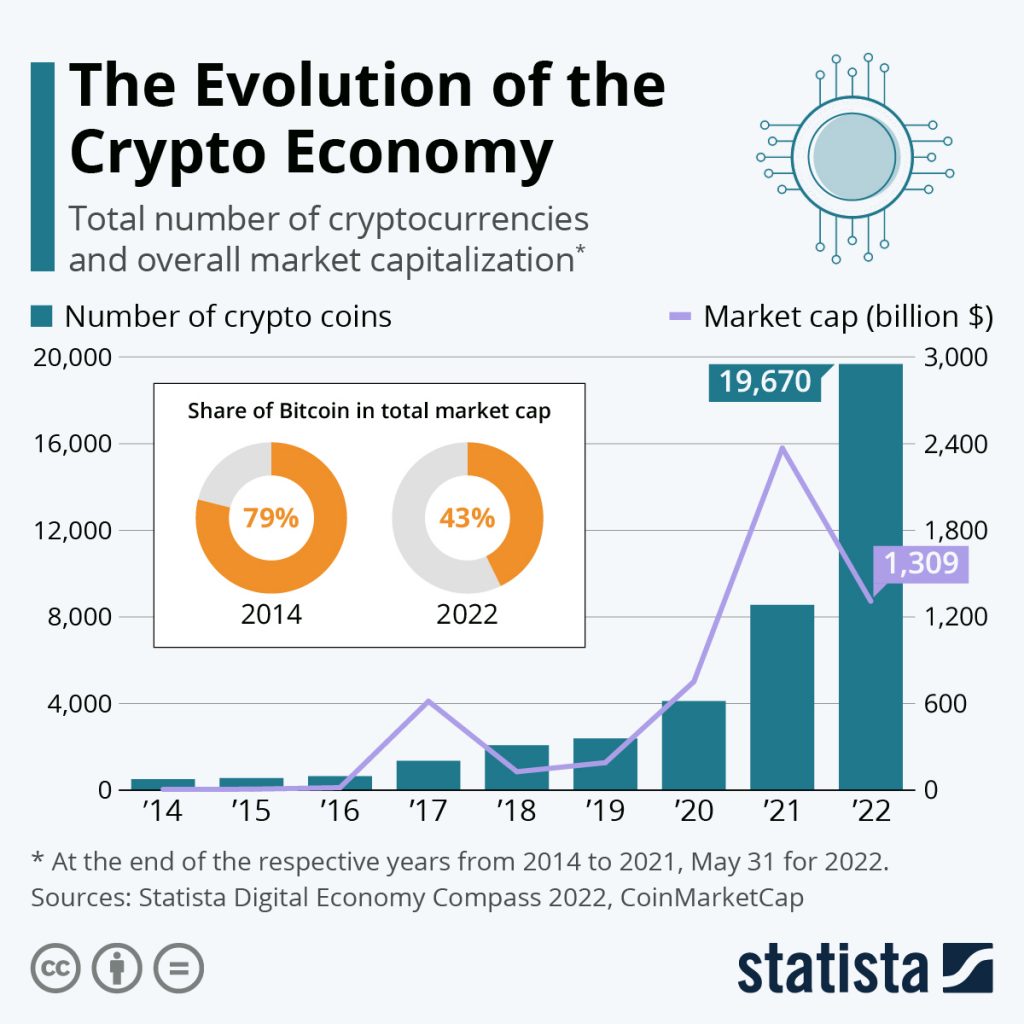

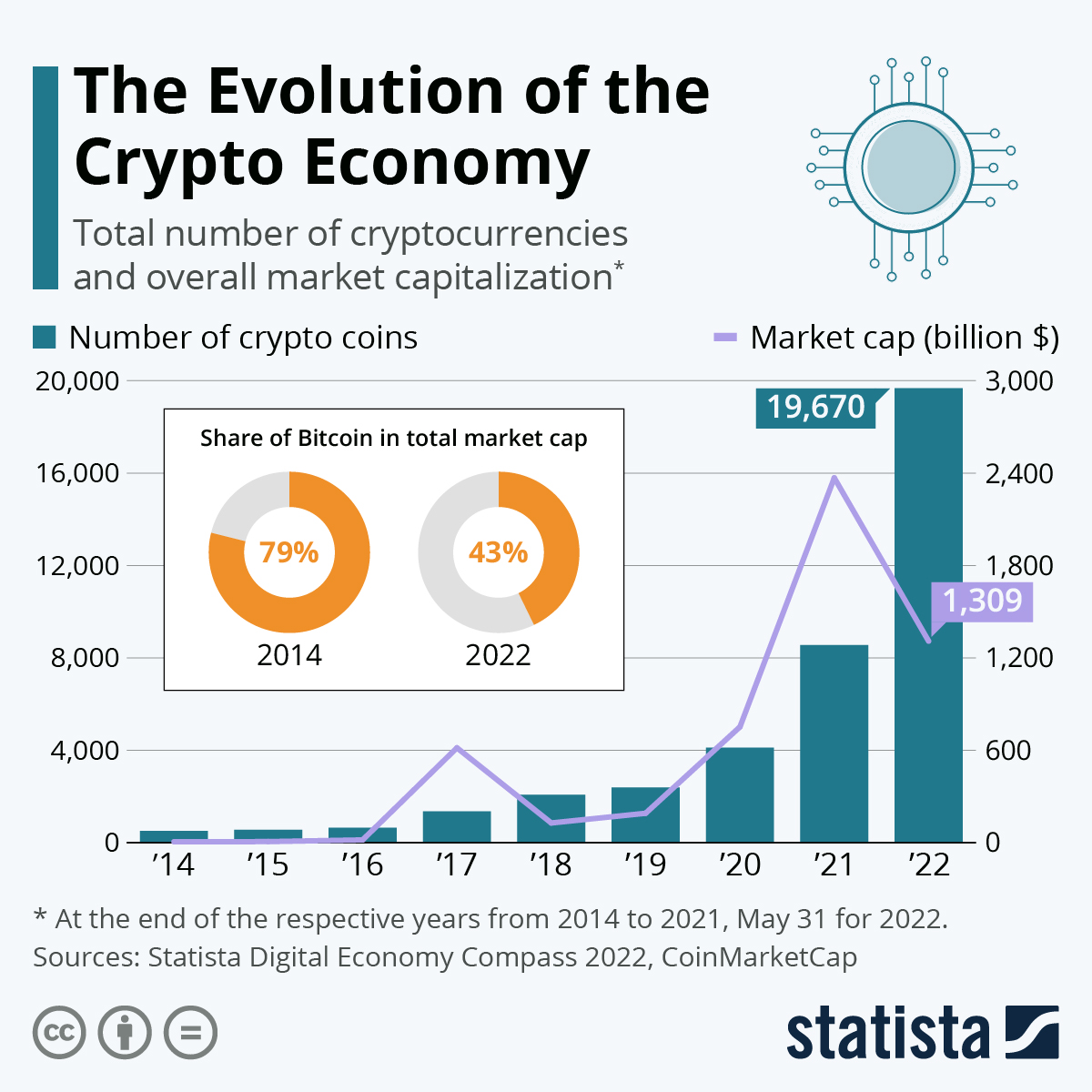

Current Market Overview

The cryptocurrency market has recently experienced a notable downturn, with several major coins witnessing significant price declines. This market shift has raised concerns among investors and analysts alike, prompting a closer examination of the underlying trends and contributing factors. The current landscape presents a challenging environment for cryptocurrency enthusiasts, with many seeking clarity on the reasons behind these price drops.Recent trends indicate a sizable decline in the values of numerous cryptocurrencies, particularly Bitcoin and Ethereum, which have been perceived as bellwethers for the market.

These declines can be attributed to a combination of economic factors, regulatory changes, and shifts in market sentiment. Understanding these influences is crucial for investors navigating this volatile landscape.

Economic Factors

Economic conditions play a pivotal role in shaping the cryptocurrency market. Inflation has emerged as a significant concern, impacting investor confidence and driving down prices. As inflation rates rise, the purchasing power of fiat currencies diminishes, leading investors to seek alternative assets, including cryptocurrencies. However, when inflation fears escalate, volatility often ensues, causing prices to fluctuate wildly.Interest rate changes also influence the dynamics of the crypto market.

For instance, when interest rates rise, borrowing costs increase, which can lead to reduced investment in higher-risk assets like cryptocurrencies. This creates a ripple effect, often resulting in declining prices as investors shift their focus to safer, more stable investments. Furthermore, global economic events, such as the ongoing geopolitical tensions or economic slowdowns in key markets, can also correlate with falling crypto prices, as uncertainty breeds caution among investors.

Regulatory Influences

Recent regulatory developments have significantly impacted the cryptocurrency landscape. Governments across major economies are increasingly scrutinizing the crypto market, resulting in a range of policies that affect how cryptocurrencies are traded and taxed. For example, stricter regulations in countries like China and the United States have led to market apprehension, causing many investors to reconsider their positions.Comparing strict regulations to lenient ones reveals distinct effects on market stability.

In regions with stringent regulations, there may be less volatility due to enforced compliance and oversight, while lenient regulations can lead to speculative trading and greater price swings. Understanding these regulatory frameworks is essential for stakeholders aiming to navigate the complexities of the crypto market effectively.

Market Sentiment

Market sentiment plays a crucial role in driving investor behavior, especially during periods of price decline. Psychological factors such as fear, uncertainty, and doubt can lead to panic selling, exacerbating price drops. Investors often rely on sentiment analysis to gauge market conditions, utilizing tools like social media trends and sentiment indices.Platforms like Twitter and Reddit have emerged as significant influencers in shaping perceptions of cryptocurrency value.

For instance, a trending negative sentiment on these platforms can trigger widespread sell-offs, while positive discussions can encourage buying. Thus, understanding the nuances of market sentiment is vital for investors looking to make informed decisions during downturns.

Technical Analysis

Technical analysis is a valuable tool for predicting price movements in the cryptocurrency market. Key indicators such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels provide insights into potential price trends. For example, when a coin falls below its moving average and the RSI indicates oversold conditions, it may signal further declines.

| Cryptocurrency | Price Movement | Market Condition |

|---|---|---|

| Bitcoin | -15% | Bearish |

| Ethereum | -12% | Bearish |

| Ripple | -20% | Bearish |

Utilizing chart patterns, such as head and shoulders or double tops, can help investors identify potential reversal points. These patterns often indicate sustained price declines, allowing traders to strategize accordingly and mitigate losses.

Investment Strategies

Investing during a falling market requires a careful approach. Strategies such as dollar-cost averaging can help investors build positions gradually while avoiding significant losses. This method allows investors to purchase assets at various price points, potentially lowering their average cost.Risk management techniques are critical during downturns. Investors should consider setting stop-loss orders to limit potential losses and ensure they have a clear exit strategy.

Additionally, diversifying portfolios can help mitigate risks, as spreading investments across different assets can buffer against volatility in any single cryptocurrency.

Future Projections

Expert predictions for the recovery of cryptocurrencies vary widely, with some analysts forecasting a rebound as markets stabilize. Innovations in the blockchain space, such as advancements in scalability and interoperability, could drive future demand and influence prices positively. A timeline of anticipated events, such as upcoming regulatory clarifications or technological advancements, may play a significant role in stabilizing the market.

As these developments unfold, investors should remain vigilant and adaptable to shifting market conditions.

Community Response

Crypto communities are actively responding to the recent price declines, fostering resilience and support among investors. Initiatives such as educational webinars and local meetups have emerged, empowering investors with knowledge and strategies to navigate the downturn effectively.Successful collective actions during previous market downturns serve as case studies for current movements. For example, grassroots efforts to promote transparency and advocate for favorable regulations have often led to positive changes in the market landscape.

Identifying and supporting initiatives that align with community values can further strengthen the ecosystem during challenging times.

Closing Summary

As we wrap up our exploration of crypto coins falling, it's evident that the landscape is both challenging and ripe with opportunities. By staying informed about market dynamics and employing effective investment strategies, investors can better navigate this uncertain terrain and potentially position themselves for future recovery.

FAQ Explained

What causes the price of cryptocurrencies to fall?

Prices can fall due to various factors including market sentiment, regulatory news, economic changes, and technical analysis patterns.

How can I protect my investments during a downturn?

Diversifying your portfolio, implementing risk management techniques, and focusing on long-term strategies can help protect your investments.

Are all cryptocurrencies affected equally by market downturns?

No, major cryptocurrencies may experience larger fluctuations than smaller altcoins, though overall market sentiment influences all cryptocurrencies to some extent.

When is the best time to invest in a falling market?

Investors should look for signs of stabilization and potential recovery, keeping a close eye on market indicators before making decisions.

What role do regulations play in cryptocurrency pricing?

Regulations can significantly influence market confidence and investor behavior, leading to price changes based on perceived stability or risk.